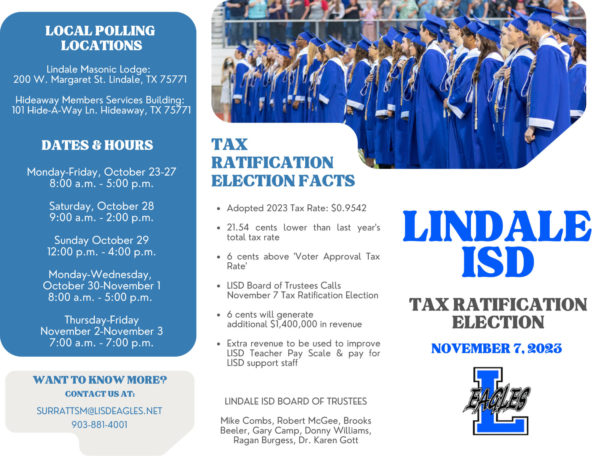

The Lindale ISD Board of Trustees has called for a Tax Ratification Election on November 7. The tax rate would be 21.54 cents lower than last year; however, it would still be 6 cents over the voter-approved rate of 27.54. Those six cents would generate funding to be used to raise the salaries of Lindale ISD teachers and support staff.

“Really, the vote is about that six cents,” Superintendent Stan Surratt said. “That six cents will generate about $1,400,000, and that’s local revenue and state revenue.”

Currently, the voter approved tax reduction rate is 27.54 cents less than last year. In order to make a change to this rate, voters must approve it. The current recommendation is to change it to a 21.54 cent rate. This would still mean a tax reduction for taxpayers.

With the extra funding, the Lindale ISD Board of Trustees has three main goals:

- to improve teacher pay

- to improve support staff pay

- to become even more financially sound

“[On November 7,] Registered voters in Lindale ISD will vote whether or not to support the board’s effort,” Surratt said. “We compete with local businesses on support staff,” Surratt said. “We also looked at the teacher scales with neighboring school districts. And a lot of school districts, because of the shortage of teachers, have raised their scales. “[For teachers] It would be $2500, so every step on the Lindale ISD pay scale would increase $2500.”

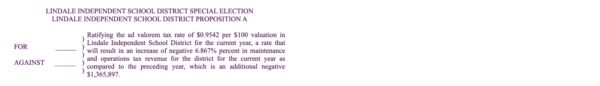

In the wording on the election form, it uses the phrase “increase of negative 6.867%,” which is confusing to some readers. Many have expressed concerns that this will be a tax ‘increase’ from last year’s rate. However, it is not a tax increase. Taxes will go down with either choice. The tax ratification election just asks voters to take a 21.54 cent reduction instead of a 27.55 cent reduction.

“I think we have a great plan in place, where we want to look at each year adding to the scale and moving the scale forward. Of course, support staff pay always needs to be improved. They’re drastically needed throughout the entire district.”

Added funding for school staff has been discussed prior to this point, but problems at the state legislative level have caused a lack of funding for the upcoming year.

“The reason we haven’t had improved funding already is because legislators attached vouchers to every funding bill,” Surratt said. “Vouchers can’t pass on their own merit, and because they can’t pass on their own merit, they actually killed the funding bills for schools.”

Voters will also vote on the Homestead Exemption at the November 7 election. With this act, exemption on houses will go from $40,000 up to $100,000. This means that homeowners will pay up to $60,000 less value on their property.

“It’s a great tax cut as well, and it’s from the legislature and people who vote statewide,” Surratt said. “Most people are going to vote for and it’ll pass, but if you want teacher pay to increase and pay for support staff, you vote for [the tax rate measure], as well.”